Start Simple. Build Wealth.

At NITESH CAPITAL, we provide tailored investment solutions to help you achieve your financial goals. Whether it's wealth creation, retirement planning, or securing your family's future, we simplify investing for everyone.

About Us

Driven by Knowledge, Built on Trust

Welcome to NITESH CAPITAL, your trusted financial partner in India. We understand that your financial journey is more than just numbers – it's about achieving your dreams, securing your future, and building a lasting legacy. At NITESH CAPITAL, we provide expert guidance, personalized solutions, and a client-first approach to help you grow and protect your wealth.

20+ Years of Experience

Proven track record of guiding clients towards long-term financial success.

120cr+ Assets Managed

Expertise in managing diversified portfolios to maximize wealth growth.

11,000+ Clients Served

Trusted by thousands of investors for personalized and transparent financial guidance.

Goal-Based Planning

Customized investment strategies aligned with your financial goals and risk profile.

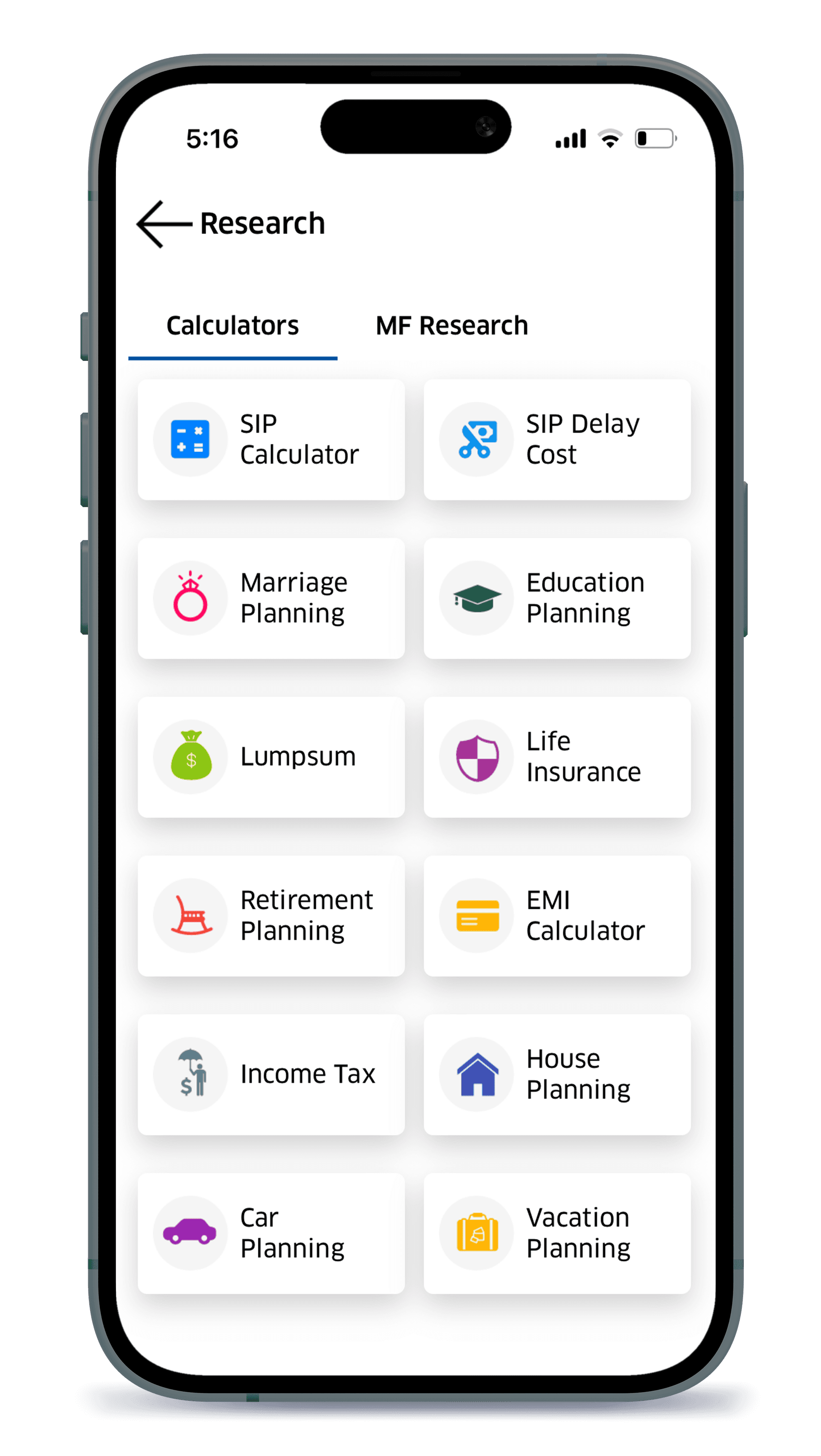

Financial Tools

Investing Made Simple

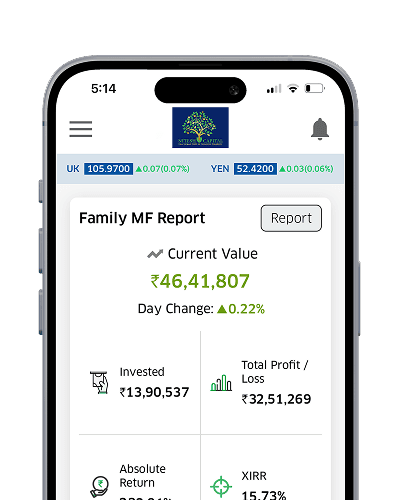

Investing made easy with smart and simple tools that break down complexity, give you real-time visibility into your portfolio, and let you invest with confidence.

Financial Calculators

Plan smarter with calculators for SIP, SWP, retirement, goals, and EMIs — all designed to help you make data-driven financial decisions.

Financial Health Check

Evaluate your overall financial health and get clarity on savings, risk exposure, and long-term goals with a simple, guided assessment.

Pay Premium Online

Make secure, hassle-free online premium payments for your insurance policies directly through trusted partner platforms.

Useful Financial Links

Access important and verified financial resources, government portals, regulatory links, and investment-related tools — all in one place.

Risk Profiling

Identify your investment risk appetite with our quick risk profiler. Get clarity on whether you are conservative, moderate, or aggressive.

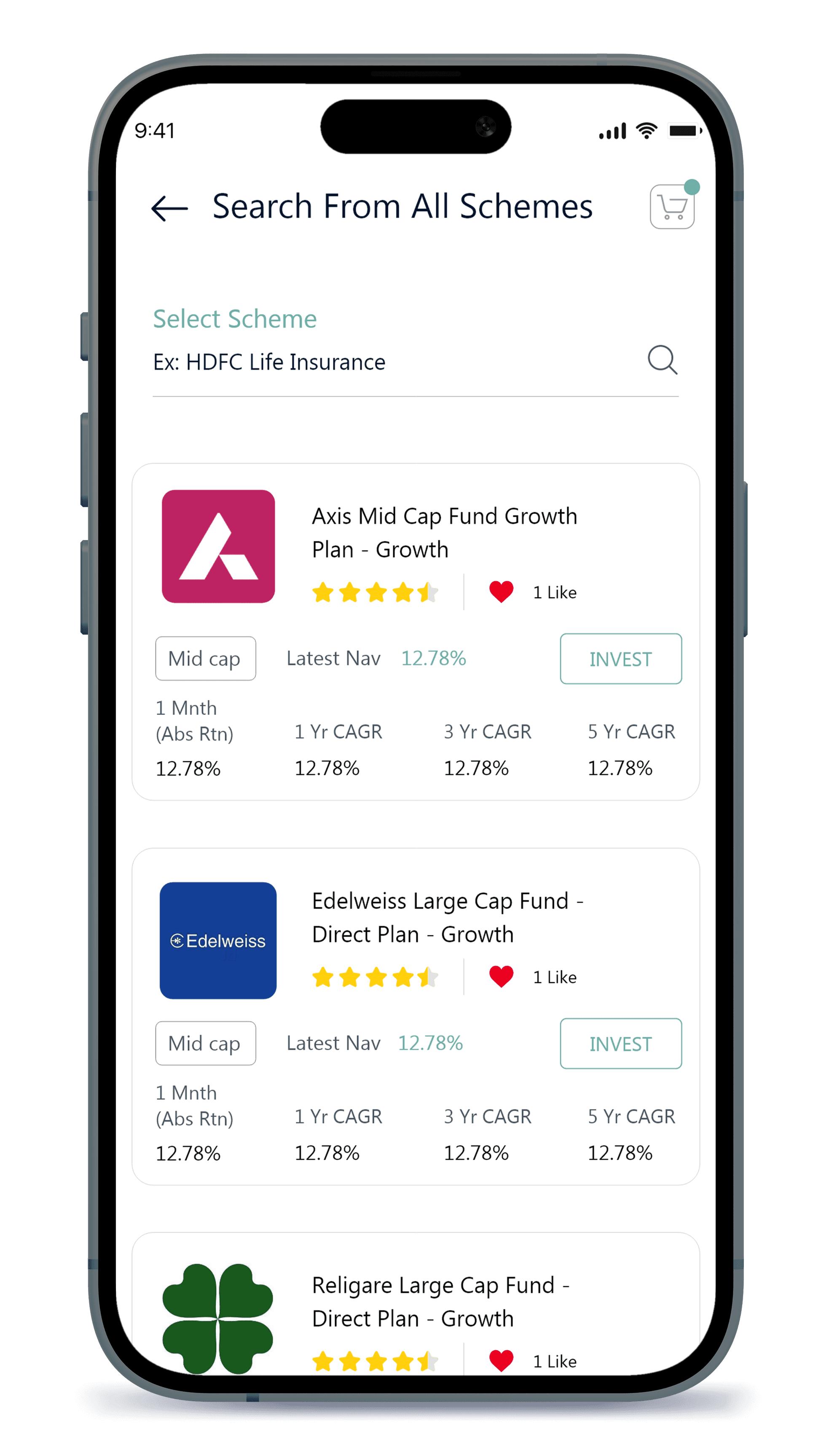

Fund Performance

Review the latest mutual fund performance metrics, compare historical returns, and make informed investment choices confidently.

Financial Calculators

Plan smarter with calculators for SIP, SWP, retirement, goals, and EMIs — all designed to help you make data-driven financial decisions.

Financial Health Check

Evaluate your overall financial health and get clarity on savings, risk exposure, and long-term goals with a simple, guided assessment.

Pay Premium Online

Make secure, hassle-free online premium payments for your insurance policies directly through trusted partner platforms.

Useful Financial Links

Access important and verified financial resources, government portals, regulatory links, and investment-related tools — all in one place.

Risk Profiling

Identify your investment risk appetite with our quick risk profiler. Get clarity on whether you are conservative, moderate, or aggressive.

Fund Performance

Review the latest mutual fund performance metrics, compare historical returns, and make informed investment choices confidently.

TOP PERFORMING FUNDS

Historical Performance of Funds

No data available.

Services

Explore What We Offer?

Investing made easy with smart and simple tools that break down complexity, give you real-time visibility into your portfolio, and let you invest with confidence.

Direct vs Regular

Know the Key Differences

Direct Plans

०

Investor handles everything independently – fund selection, asset allocation, monitoring, and rebalancing.०

Lower expense ratio since no distributor commission is involved.०

Requires deep research, market understanding, and consistent follow-ups.०

No personalised guidance — decisions are based on self-judgment only.०

Higher chances of emotional or impulsive decisions during market volatility.०

Suitable mainly for experienced or DIY investors who prefer full control.

Regular Plans

०

Expert guidance from a qualified MFD — right from fund selection to ongoing review.०

Slightly higher expense ratio, but includes professional support and servicing.०

MFD manages documentation, portfolio tracking, redemptions, and even KYC help.०

Investments are customised as per your goals, risk profile, and market outlook.०

Helps maintain discipline, avoids panic selling, and ensures long-term focus.०

Preferred by majority investors who value personalised service and expert advice.

Different Funds

Choose the Right Investment Platform

The same monthly investment can create different outcomes depending on where you invest. Compare returns across Savings Account, FD, Gold, and Mutual Funds to understand how smart investing can accelerate your wealth creation.

₹ 7,00,454

Saving Account

(with 3% return)

₹ 8,23,494

Fixed Deposit

(with 6% return)

₹ 9,74,828

Gold

(with 9% return)

₹ 13,93,286

Mutual Fund

(with 15% return)

Our Team

People Behind Your Portfolio

We’re a team of SEBI-registered experts who help you plan, track, and tweak your investments.

Nitesh Barpagga

Founder

Blogs

Our Latest News & Articles

Testimonials

What Our Clients Say

Real experiences from investors who’ve trusted us with their financial journey.

Vivek Gupta

EntrepreneurFrom planning to execution, every step was smooth. Their expertise in mutual funds is top-notch.

Sneha Rao

Marketing ManagerProfessional, transparent, and trustworthy – NITESH CAPITAL has helped me achieve my investment goals effectively.

Rakesh Sharma

Business OwnerNITESH CAPITAL has completely transformed the way I invest. Their guidance is clear, personalized, and always reliable.

Call for Assistance

+919891523290Reach Us via Email

niteshbarpagga@gmail.comStart Your

Journey With Us

Whether you need expert guidance, personalized financial strategies, or answers to your questions, our team is here to help you move forward with clarity and confidence.